Monarca Trucking Insurance Services

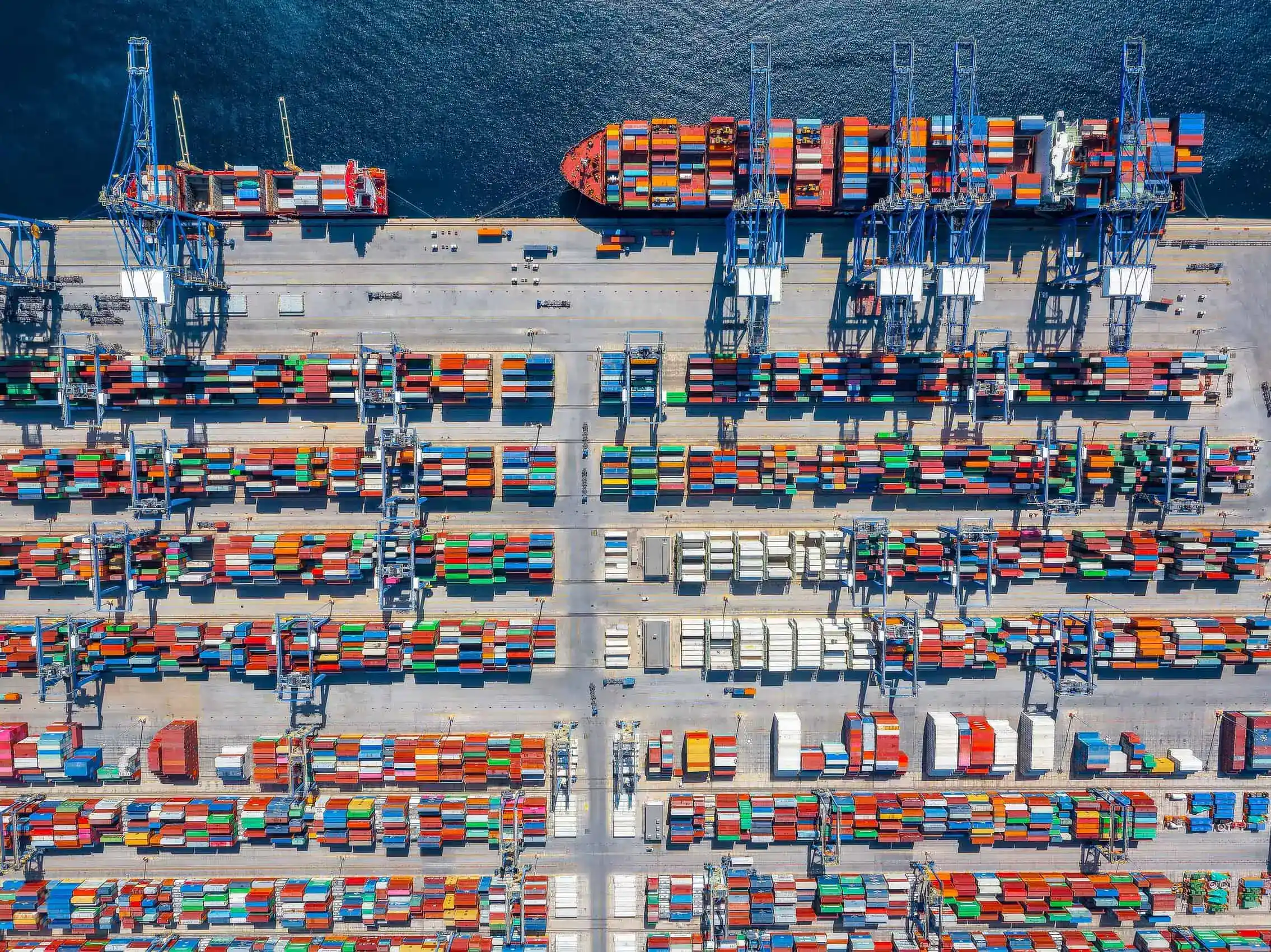

Intermodal Trucking Insurance in California & beyond

Experience easy access to affordable, high-quality Intermodal Trucking Insurance at Monarca Trucking Insurance Services.

Get your Intermodal Trucking Insurance quote below!

Monarca Trucking Insurance Services | Insurance in California

What is Intermodal Trucking Insurance?

Intermodal trucking plays a critical role in modern logistics, moving freight seamlessly between rail yards, ports, and distribution centers. With multiple handoffs, tight schedules, and high-value cargo, the risks involved are very different from standard over-the-road hauling. Intermodal trucking insurance is designed to address those unique exposures, helping motor carriers manage liability, cargo concerns, and operational interruptions that can arise at any point in the transport process.

At Monarca Trucking Insurance Services, we work with intermodal trucking businesses of all sizes, from single-truck operators to established fleets. Our role is to help clients understand how coverage may respond as freight moves across modes of transportation. Because intermodal operations rarely fit into a one-size-fits-all policy, insurance solutions are often tailored to reflect equipment usage, terminal access requirements, and contractual obligations with rail providers or shippers.

What Risks Do Intermodal Trucking Operations Face in California?

Intermodal trucking in California presents a unique mix of regulatory, geographic, and operational challenges. Busy ports, congested rail terminals, and strict state compliance standards can all increase exposure to claims. Drivers may face heightened accident risks when navigating urban corridors or terminal environments where trucks, trains, and heavy equipment operate in close quarters.

Beyond accidents, intermodal carriers often assume responsibility for cargo during critical transitions between rail and truck. Delays, miscommunication, or terminal congestion may lead to cargo damage, spoilage, or contractual disputes. California’s regulatory landscape can also affect insurance requirements, particularly when it comes to liability limits, worker classification, and environmental considerations. Intermodal trucking insurance may help address these layered risks by aligning coverage with how freight actually moves through the state.

What Types of Coverage May Be Included in Intermodal Trucking Insurance?

Intermodal trucking insurance often combines several coverage components designed to work together. While policy structures vary, they may include auto liability to address bodily injury or property damage caused by covered vehicles. Physical damage coverage is commonly used to help protect tractors and trailers from losses related to collisions, theft, or vandalism.

Cargo coverage is especially important in intermodal operations, where responsibility for freight may shift depending on contracts and handoff points. Policies may also include general liability for non-auto exposures, along with optional coverages such as terminal coverage, non-owned trailer protection, or equipment coverage. Because intermodal carriers frequently operate under agreements with railroads or ports, insurance may be structured to align with contractual insurance requirements without unnecessary overlap.

How Can Truckers Get a Quote For Intermodal Trucking Insurance in California?

If you operate intermodal trucks in California, having insurance that reflects your real-world risks matters. Monarca Trucking Insurance Services works with trucking businesses to explore insurance solutions aligned with job site operations, contractual requirements, and fleet needs. Whether you’re reviewing an existing policy or planning for growth, connect with our team to discuss coverage options that may support your operation and help you move forward with confidence.

Headquarters

1050 Lakes Dr, Suite 225,

#PMB3142, West Covina, CA 91790